News

Sign Up to receive our monthly newsletters.

LATEST NEWS

-

Our favourite Document Collection & Management Apps

Are you too busy to visit our office to drop off your documents? Upload your receipts & documents directly into document collection & management apps that feed directly into your accounting software! Hubdoc & Dext are our favourite document collection & management apps. They extract key data from documents using AI. They each have both […]

Read More -

Volunteer Firefighter &/or Search & Rescue Tax Credits

Were you a Volunteer Firefighter &/or Search & Rescue Volunteer? Did you complete at least 200 hours of eligible volunteer firefighting services or search & rescue volunteer services in the year? October is Fire Prevention month, so we thought we’d let you know there’s a tax credit available for Volunteer Firefighter &/or Search & Rescue […]

Read More -

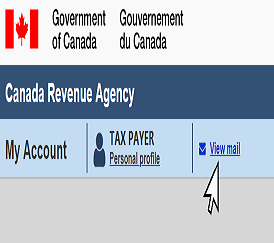

Setting up a My Account

Here is a list of information you will need in order to setup your My Account with Canada Revenue Agency (CRA): 1 ) Your social insurance number (SIN) 2) Your date of birth 3) Your postal code 4 ) Your last 2 tax returns ex. current year and the previous one-CRA will require a line […]

Read More -

Political Contributions

Federal Contributions With the election today, we wanted to do a post about political contributions. Did you know that your Federal political contributions are made directly to a registered political party or a candidate for the election, to the House of Commons? Your contribution can be claimed by either you or your spouse, but it […]

Read More -

September 2021

SharGlen Financial Inc. Private Health Spending Program (PHSP) Are you using SharGlen Financial Inc. to process your PHSP? They now accept e-transfers! To send an e-transfer please use the email phsp@sharglen.ca Never heard of this before? To learn more about this program & read the rest of the newsletter. Photo by Mahnoor Shams on Unsplash

Read More -

Our Favourite Password Manager Apps

To protect yourself from password leaks, all your accounts should have strong, long, unpredictable passwords that contain numbers & symbols. Remembering these passwords is nearly impossible without resorting to some sort of trick or memory aid. An ideal choice is using a password manager app that generates secure, random passwords for you & remembers them, […]

Read More -

MyAlberta Digital ID

Have you heard of MyAlberta Digital ID? This is an account that lets you prove your identity online without paper documents or face-to-face visits. It gives you access to multiple government sites & services, while protecting your information and privacy. Here is a list of some key sites & services you can access through just […]

Read More -

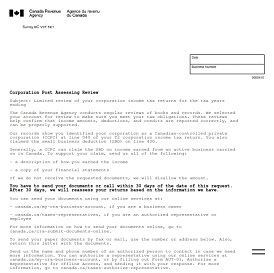

Small Business Deduction Reviews

Our team at Gadowsky & Associates LLP has seen an increase of corporate post assessment reviews from Canada Revenue Agency in regards to claiming the small business deduction. In order to claim this deduction on your corporate tax return, your corporation must have earned income from active business within Canada. This deduction has a business […]

Read More -

Government Wage Subsidies

Canada Emergency Wage Subsidy (CEWS) Have you seen a drop in revenue during the COVID-19 pandemic? You may be eligible for a subsidy to cover some of your employee wages. This will assist you as you start re-hiring & get your business back into normal operations. The decline in revenue does not have to be related […]

Read More -

August 2021

The federal government announced the new National Day for Truth & Reconciliation statutory holiday. Created for all federal employees, it will take place on September 30, 2021. This day recognizes & commemorates the legacy of residential schools. Previously known as Orange Shirt day; it honoured the Indigenous residential school survivors, their families & communities as […]

Read More -

Some of Our Favorite Mileage Apps

Canada Revenue Agency (CRA) requires an accurate logbook, you can use one of the following mileage apps to create that logbook for you! This logbook needs to be maintained for business travel for the entire year as a part of your year end support. This logbook will show for each business trip, the destination, the […]

Read More -

Alberta Jobs Now program

The Alberta government has come up with a program called Alberta Jobs Now. This is to help our economy by providing private & non-profit business with job support. There is certain requirements that need to be met in order to qualify for the program. Employers can apply for the program to help offset the cost […]

Read More -

July 2021

As of June 28, 2021, Processing Review letters are starting to be sent out by Canada Revenue Agency (CRA). These relate to the personal income tax returns for 2020. The letters will either be mailed out or in your CRA MyAccount if it is set up for online mail. If you receive one, please let us know so we […]

Read More -

COVID-19 Update July 2021

The Alberta Government lifted all restrictions July 1st. So here are the changes in our offices: We want you to feel comfortable when you come in, so we are still social distancing & are keeping up our sanitization procedures. Let us know your concerns when you call to book your appointment, book your appointment online […]

Read More -

June 2021

In the 2021 Budget, the Federal government proposed a new subsidy called Canada Recovery Hiring Program (CRHP). If you were to qualify, this could help you pay wages for eligible employees. But you cannot claim both CRHP & CEWS. See our newsletter for more detail or contact us if you have questions. Photo by Hendrik […]

Read More -

COVID-19 Update May 2021

As COVID-19 continues to affect all aspects of our lives, Gadowsky & Associates LLP is constantly improving our safety measures. Our goal is to ensure we follow government protocols, and keep you as safe as possible when you visit our offices. Glen & Richard are only taking appointments in the Edmonton office. Additionally, Shirley & Sylvia […]

Read More -

April 2021

More grants are now available, and subsidies are continuing to be offered. You may be eligible for more than one grant or subsidy. Need help trying to figure out if you qualify for a grant or subsidy we are here to assist you! See our newsletter for more details! Photo by Emily Cao on Unsplash

Read More -

March 2021

If you worked from home in 2020 due to COVID-19, you may be able to claim certain employment expenses. If you claimed employment expense previously you will have to use the detailed T2200. See our newsletter for details. Photo by Ekaterina Novitskaya on Unsplash

Read More -

February 2021

Reminder the filing deadline for 2020 T4 & T5 slips is February 28th, 2021. Please make sure you have submitted all the necessary information for us to file on time. Reach out to us to make sure we have everything we need if we file your T4 & T5 slips. See our newsletter for other […]

Read More -

January 2021

Reminder to check emails for our pre-season letter & checklist for your 2020 personal income tax return(s) for all of our current client(s). If you did not receive it yet please contact us. These checklist are very help in making sure you have all your documents to bring in your return(s). See our newsletter for more […]

Read More -

Working Parent’s Benefit

To support working parents who need and have paid for childcare so they can continue working during the pandemic. The Alberta government is providing the Working Parent’s Benefit which is a one-time payment of $561 per child. Parents who used child care from April to December of 2020 while working or attending school, can apply […]

Read More