News

Sign Up to receive our monthly newsletters.

LATEST NEWS

Small Business Deduction Reviews

Our team at Gadowsky & Associates LLP has seen an increase of corporate post assessment reviews from Canada Revenue Agency in regards to claiming the small business deduction. In order to claim this deduction on your corporate tax return, your corporation must have earned income from active business within Canada. This deduction has a business limit that must be shared amongst associated corporations in a taxation year & is reduced by any portion that is assigned to another associated corporation.

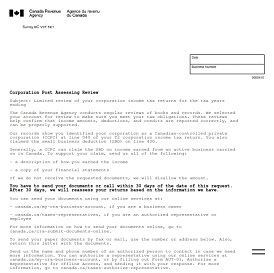

Here is a sample of the wording on the letter:

Our records show you identified your corporation as a Canadian-controlled private

corporation (CCPC) at line 040 of your T2 corporation income tax return. You also

claimed the small business deduction (SBD) on line 430.

Generally, a CCPC can claim the SBD on income earned from an active business carried

on in Canada. To support your claim, send us all of the following:1) a description of how you earned the income

2) a copy of your financial statements

If we do not receive the requested documents, we will disallow the amount.You have to send your documents or call within 30 days of the date of this request.

Canada Revenue Agency

After 30 days, we will reassess your returns based on the information we have.

You can send your documents using our online services at:

If you receive one of these letters we are here to assist you with submitting the necessary documents to Canada Revenue Agency. If you already have Audit Shield, reviews of this nature would be eligible for coverage.